personal property tax car richmond va

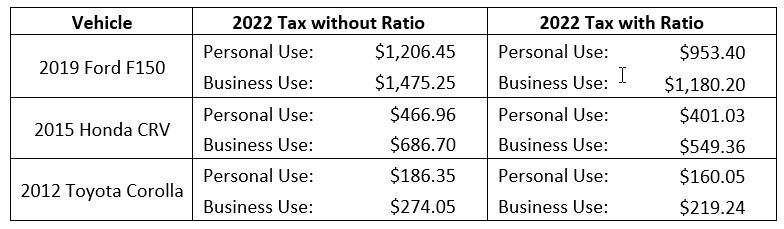

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. With supply chain problems driving up vehicle.

Vendor Due Diligence Report Template 6 Templates Example Templates Example Report Template Checklist Template Project Management Templates

Broad Street Richmond VA 23219.

. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Richmond Finance Director Sheila White explains reason for city extension on personal property tax May 31 2022 May 31. The non-prorating locality will not assess the vehicle for property taxes until the next tax year.

Parking Violations Online Payment. Tax Due Date Extended by City Council Action. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Questions answered every 9 seconds. Does Your Vehicle Qualify for Personal Property Tax Relief. The personal property tax is.

Is more than 50 of. Therefore the vehicle is subject to. Restaurants In Matthews Nc That Deliver.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the. WRIC The City of Richmond has extended the due date for personal. Richmond City collects on average 105 of a propertys assessed.

Pay Your Parking Violation. Since the taxable situs of the vehicle on January 1 was the City of Richmond the vehicle is subject to personal property taxes in the City of Richmond. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia. The county also can. Taxpayers now have until August 5 2022 to pay personal property tax car tax and machinery tools tax without penalty or interest.

Tangible Personal Property Tax 581-3503. If you can answer YES to any. The Personal Property Tax rate is 533 per 100 533 of the.

Personal property taxes are billed annually with a due date of december 5 th. Opry Mills Breakfast Restaurants. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn.

Jun 2 2022 1110 AM EDT. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the. Call 804 646-7000 or send an email to the Department of Finance.

My office has used the same assessment. Jun 2 2022 1110 AM EDT. Jun 1 2022 0608 PM EDT.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Personal property tax car richmond va Tuesday March 22 2022 Edit. Personal Property Tax Car Richmond Va.

Monday - Friday 8am - 5pm. The property taxes on motor vehicles and trailers are prorated based on the date of purchase or the date the vehicle acquires taxable situs in the City of Richmond on an even. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Personal Property Taxes are billed once a year with a December. Personal Property Tax is responsible for the assessment of all vehicles cars trucks buses motorcycles boats and motor homes that are taxable in the City of Alexandria. Parking tickets can now be paid online.

Personal property tax car richmond va. Learn all about Richmond real estate tax. Click Here to Pay.

WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City. Team Papergov 1 year ago.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

/do0bihdskp9dy.cloudfront.net/05-03-2022/t_f6354703607e435da6218e4d66094835_name_file_1280x720_2000_v3_1_.jpg)

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Henrico County Announces Plans On Personal Property Tax Relief

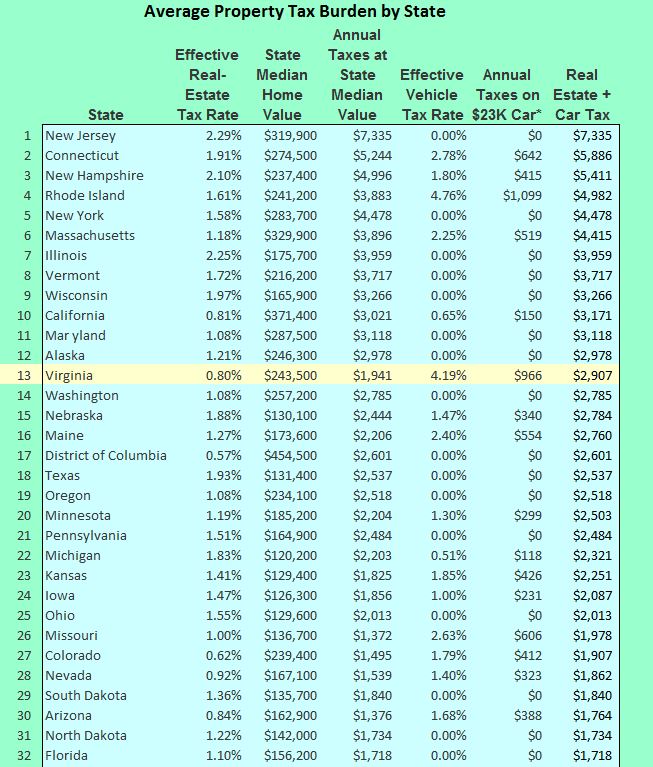

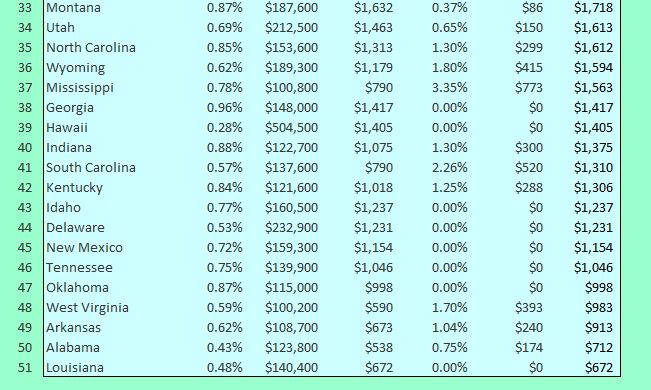

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Chesterfield County Virginia Government Explaining Personal Property Tax Statements Facebook By Chesterfield County Virginia Government

Property Taxes How Much Are They In Different States Across The Us

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

Wood Burning For Domestic Heating Usa By Metric Maps Map Usa Energy Map Cartography Energy Issues

Pay Online Chesterfield County Va

Virginia S Personal Property Taxes On The Rise 13newsnow Com

Many Left Frustrated As Personal Property Tax Bills Increase